The balance sheet shows the financial status of the business on a fixed date. This date is usually the last date of the accounting year. The balance sheet also gives information about the refining capacity of the institutions.

Why We Need a Balance Sheet?

Position Statement, from the balance sheet, believes that the business is not bankrupt and it is moving towards the path of progress.

Any person who puts his money in an institution has the right to know that his wealth is not being misused.

So at the end of an accounting period, all assets and liabilities are listed from individual accounts on the trial balance and then added up together, with light items grouped together.

The balance sheet is divided by the following formula:

Assets = Liabilities + Owner’s Equity

liabilities and Owner’s Equity and Assets have been Defined by the International accounting standards board(IASB).

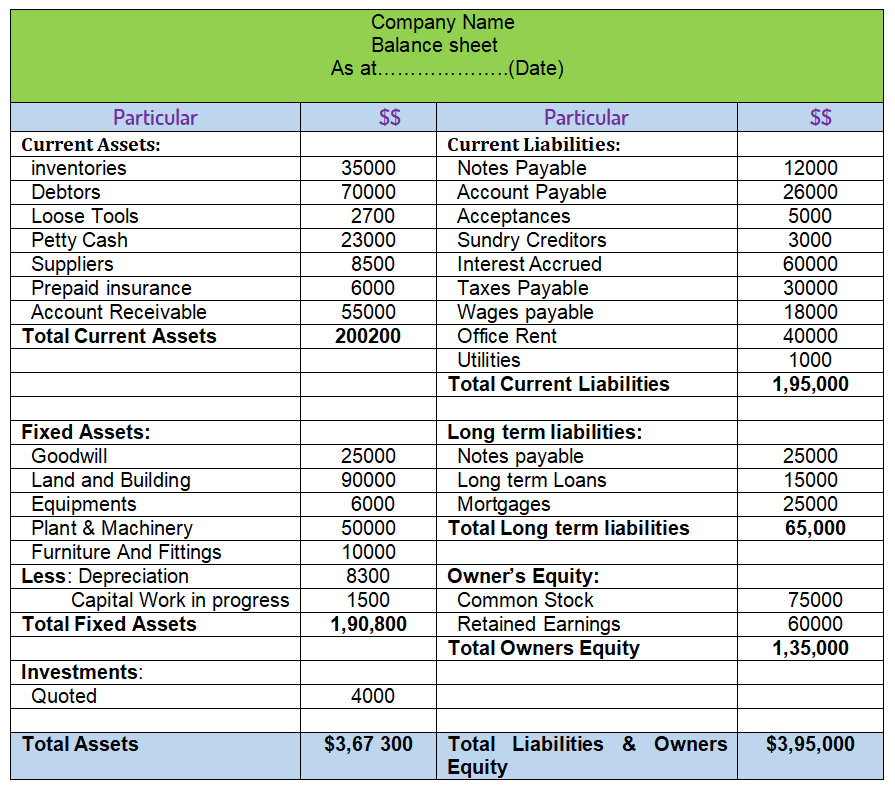

Balance Sheet Format Example

“Assets” Format in balance Sheet

1. Non-Current Assets

Non-current assets are assets that are not kept for sale purposes. But rather to increase the capacity of the entity, they are classified into 1. Fixed assets 2. further ongoing investment 3. deferred property 4. long-term loans and advances and 5. other Non-current assets.

Fixed Assets:

Tangible Assets

Those assets have a physical nature and can be seen and touched.

This includes:

- Land,

- Buildings,

- Plant,

- Machinery,

- Furniture,

- Vehicle,

- Office equipment, and all other Tangible assets.

Intangible Assets

These are Intangible Assets which does not have physical nature and can not be seen or touched:

- Goodwill,

- Trademarks,

- Brands,

- Mining rights,

- Patents,

- Copyrights,

- Computer Software,

- Services and Operating Rights,

- Recipes,

- Formulas,

- Models and Designs,

- Licenses Franchises and other privileges are reported in these Intangible assets.

Capital work in progress

Such capital assets are included in the Capital work in progress which is incomplete.

Intangible Assets under development

Intangible assets such as patents and intellectual property rights are being developed by the company.

Non-current investment

It is an investment that is not kept for the purpose of resale, they will be classified as trade investment and other appropriations in addition to the following:

- Trade investment, land, or building that has been taken to earn the rent for capital growth, not for the production or supply of goods or for use in business operation.

- Investment in Equity Instruments.

- investment in preference shares.

- Also investment in loan papers or mutual funds, government or trust securities.

Deferred Tax Assets

A deferred tax asset is recognized for the carry forward of unused tax losses to the extent of the existing taxable temporary differences, of an appropriate type, that reverse in an appropriate period.

Long-term loans and advances

They are loans and advances which will not be available in the form of cash or Assets in a period of 12 months and will be classified as follows:

- Capital Advance,

- Security Deposit,

- Loans, and Advances to Parties.

Other non-current assets

- Trade and Other Receivables.

- Others.

2. Current Assets

An asset will be classified as the current asset only when it is recoverable from the normal operating cycle of the property business and is retained for the main business purpose and is recoverable within 12 months after the reporting date.

Current Investments

Investments that can be made to change Liquid within 12 months.

investments in equity instruments, investments in preference shares, government and Trust securities, debentures or bonds, mutual funds, partnership firms, individual Investments, and others

Inventories

Raw material, work in progress, finished goods, stock in trade, loose tools, store, spare parts, and others.

Trade receivables

It involves the various debtors and bills receivables which mature in 1 year.

Cash and Cash Equivalents

It involves the bank balance, cash balance, cheque, and draught on hand.

Short-term loans and advances

The concerned parties will display loans and advances and other loans and advances individually.

They will be divided into safe and unsafe.

Other Current Assets

Includes current Assets that are not suitable for any other assets.

Example: Prepaid expenses and advance tax.

“Liabilities” Format in Balance sheet

1. Non-Current Liabilities

The obligations included in this headline are not classified as current liabilities.

Long-term Borrowings

Long-term borrowings will be described in the following words bonds, debentures, Terms loan from the bank, from other parties, deposits, and others.

2. Deferred Tax Liabilities (Net)

The deferred tax liability is calculated due to the tax on the difference between accounting income and taxable.

If taxable income is less than the accounting income then the tax liability on the amount of difference will be called.

On the contrary, taxable income, if the accounting income exceeds, will be the property by postponing the amount of difference.

Other long-term liabilities

- Trade Payables (If there is more than 12 months duration.)

- Others

- Employee Benefits and Related Provisions.

3. Current liabilities

Short-term Borrowings

Short-term Borrowings will be classified as follows:-

- Loan Re-payable on demands.

- Loans and advances from related parties.

- For banks

- For other parties.

- Deposits.

Trade Payable (If there is within 12 months duration)

Trade accounts payable (also called trades payable) refers to an amount that suppliers bill a company for delivering goods or providing services in the ordinary cause of business.

When paid on credit, the company enters the billed amounts in the accounts payable module of their accounting software or balance sheet.

4. Other Current Liabilities

- Current maturity of long-term loans.

- Current maturity of finance lease obligations.

- Interest earned on borrowings which is not payable.

- Unpaid dividend.

Short-Term Provisions

- Provision for employee benefits.

- Income Received in advance.

5. Owners’ Equity / Shareholders

Business Owners are called Shareholders.

Shareholders fund

- Share capital: 1. Common Stock 2. Preferred Stock at Per Value.

- Paid-in Capital

- Retained Earnings

- Reconciliation

- Paid-in Capital

- Number and amount of authorized Share capital (Equity and Preference stock)

- Issued; subscribed; fully paid Shares

6. Reserve and Surplus

- Capital reserves

- Capital redemption reserve

- Security premium reserve

- Debenture redemption reserve

- Revaluation reserve

- Share option outstanding Reserve

- Surplus

Thus, the Owner’s Equity formula is:

Owner’s Equity = Assets – Liabilities

Balance Sheet Formula

Liabilities = Assets – Owners Equity

Or

Owners Equity = Assets – Liabilities

Thus, the balance sheet is a very important document for a company or firm for analyzing all financials and money management.

Leave a Reply